What does loan originator software do?

The most general task of loan originator software (LOS) is to automate all the loan origination processes. However, these technologies can be used also for a single piece of work like searching for the needed documentation or tracking the payment processing. Here are other noteworthy features of loan originator software.

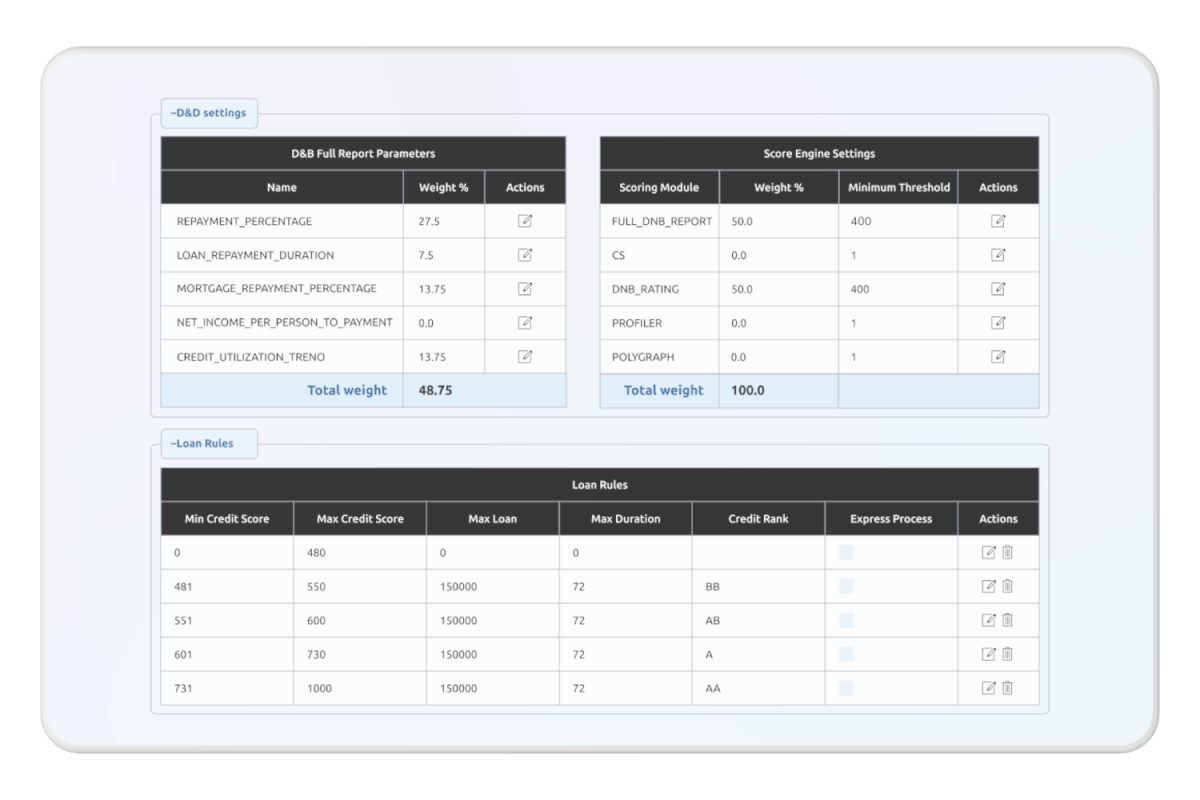

- Risk assessment. Coping with the financial side of every business is risky. And having a credit risk assistant powered by AI not only reduces the chances of a failed loan origination process but also helps to make the most profitable decisions.

- Integration of multiple aspects. The phenomenon of a loan origination system lies in its ability to keep every step, like onboarding, evaluating, or underwriting, in one place. Imagine how much time it will save you and your customers on the lending journey.

- Compliance monitoring. Submitting an application for a loan and going through its complicated process might not always be successful. But not when you use lending management software. Being able to assess the compliance of data at all stages greatly reduces the chances of loan disapproval.

Overall, loan management software is a first-class lending solution every B2B company needs.

What are the advantages of loan management platforms?

Zero-error approach

Taking into account the data and collection procedures, no doubt every human can make miscalculations. The lending lifecycle has so many details that it is impossible to end up with minimum write-offs and inaccurate results. Technologies, on the other hand, are created to serve such purposes with no errors.

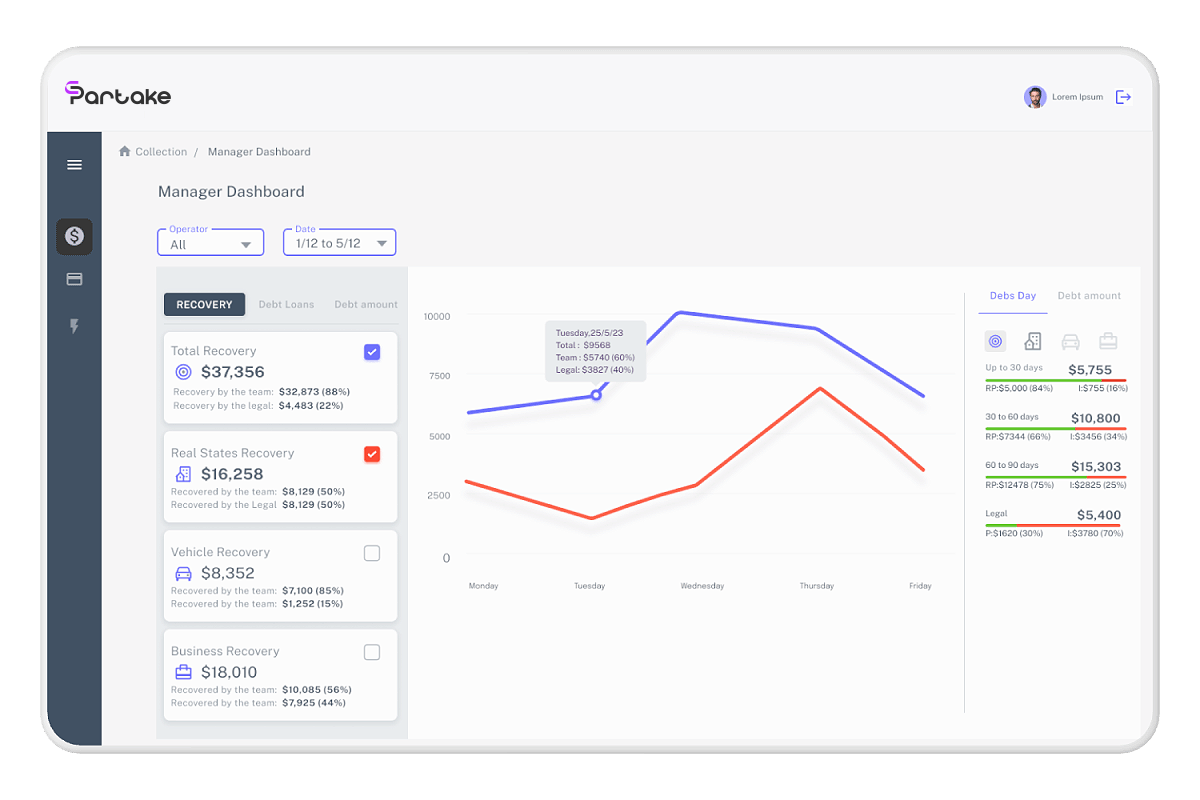

Easy-to-deliver reports

Usually, different parties, like investors and tax companies, require reports to be submitted immediately. Since these demands are urgent and essential, lending management software can give you any invoice or report immediately. The reporting feature is built-in and automated, so any report can be found within minutes.

Customer loyalty

Implementing a loan generation platform is a win-win decision for both business owners and customers. Especially for clients, automated processes at every step of a lending cycle will bring more comfort and trust. Why send documentation via emails or messengers when it can all be done inside one system?

Full transparency

There is no chance to miss any details, as accounting and collection are part of every loan management platform. You will have full access to all the data, documentation, workflows, and the loan cycle overall. So there will not be any type of incongruence for your business.

User-friendly interface

In such complicated and intricately-entwined processes as loans management, it is crucial to have software that would make things simpler. It can help business owners have well-organized data, scale, and reach global markets.

Higher revenue

Increased income will take little time with automated processes, more successful applications, more satisfied clients, and quicker procedures. While dedicating the whole lending lifecycle to an advanced platform, there will be more time for seeking opportunities and generating ideas.

Who can benefit from loan management systems?

If you are doing any type of commercial business, then you will find LOS beneficial. For startup companies, middle-size businesses, and large corporations, bringing automation and organization into a loan process will not be superfluous. Moreover, if you need to focus on one process in this cycle, you can do so.

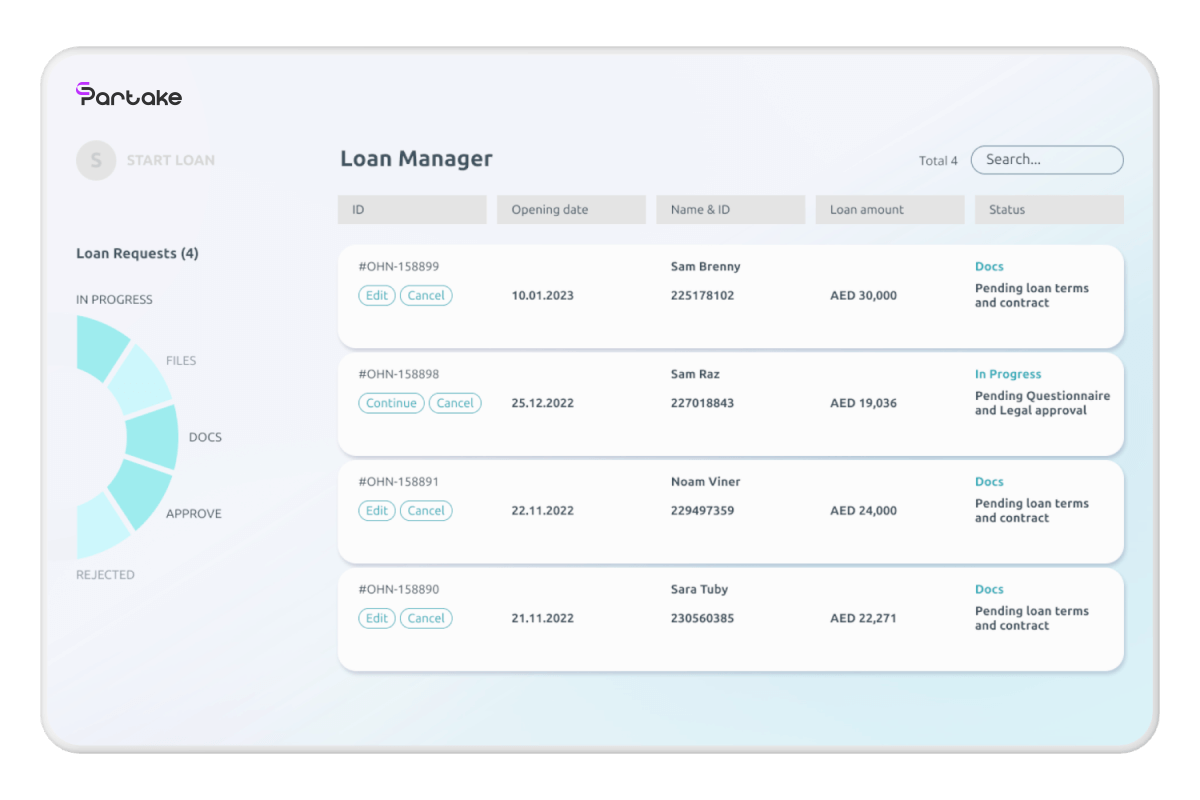

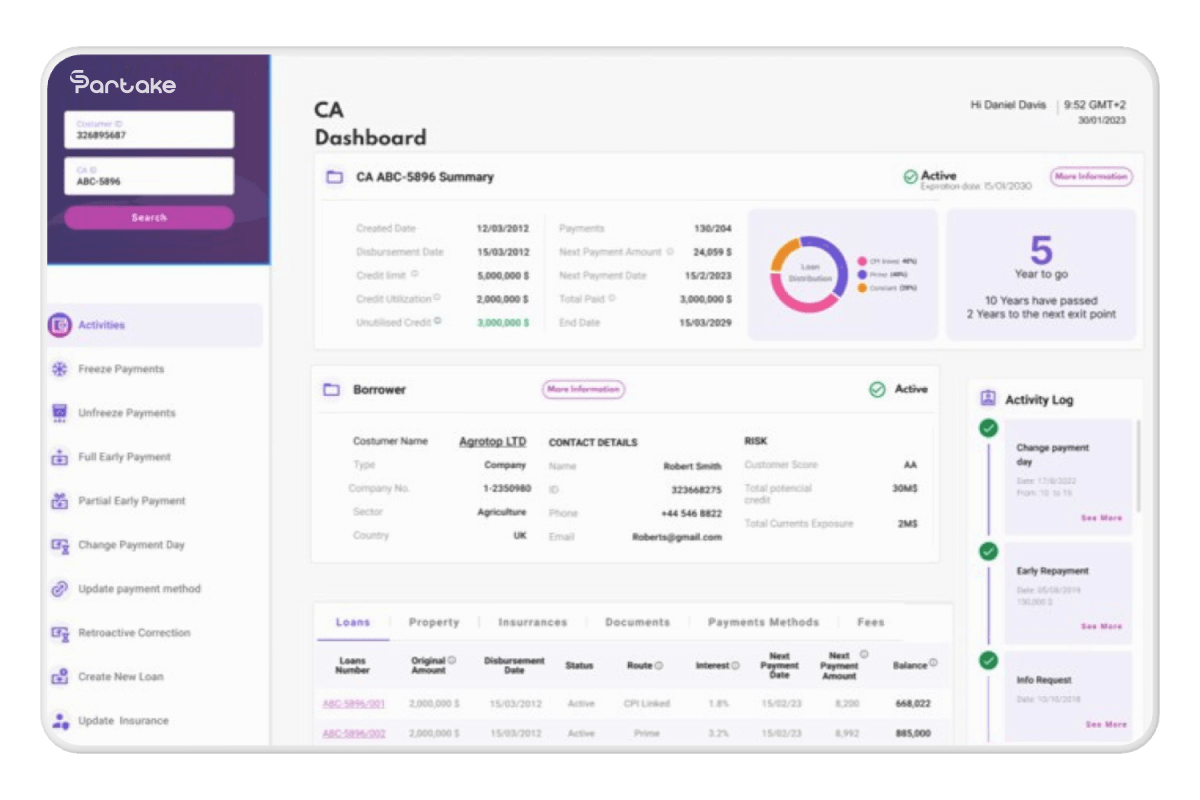

What is the Partake loan management platform?

The lending platform created by Partake is an advanced technical solution for originating any kind of loan. It is intended to provide secure loan origination while focusing on growing revenue. Partakes lending platform is a top-notch solution for those business owners who seek:

- A comprehensive software that can manage all stages of the loan lifecycle;

- A crystal-clear picture of the cash flows and all bodies involved in the operation;

- A sophisticated interface that helps find any detail without looking through the how-to-use guidelines.

Partake loan management software can handle all lending solutions and bring you and your customers a flawless experience.